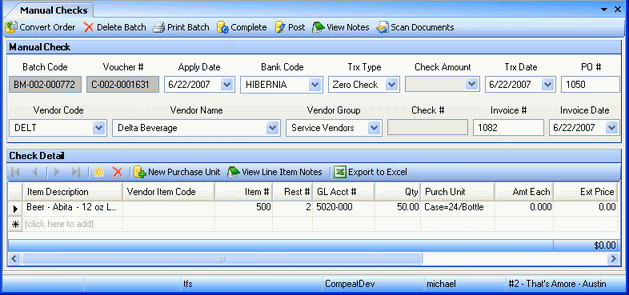

The Manual Checks screen simultaneously records and accounts for checks that are written by hand in the local restaurant. This differs from Manual Payments, which can only be used to record hand-written checks used to pay invoices that have already been entered in the AP Invoices screen. Manual checks, on the other hand, are used to pay invoices that have not been previously entered in the AP Invoices screen, and thus the accounting system; in the Manual Checks screen, you record the check and the accounting of it at the same time. Therefore, the Manual Checks screen contains many of the same fields as the AP Invoices screen.

If you need to void a manual check, you can do so under the Void Vendor Payments screen.

Quick Check are similar to Manual Checks, except they are printed through Compeat instead of hand-written. You can print Quick Checks through this screen (see Quick Checks below).

Note: When posted, manual check transactions appear in the Bank Reconciliation screen by their apply date, not check date. The apply date may not precede a reconciliation statement date for the selected bank.

Quick Tip: You can use Scan Document to scan original checks into Compeat.

Manual Checks are entered in the same way as AP Invoices, with the following two differences:

The Manual Check feature includes these unique fields:

Bank Code This field is entered by default the bank code selected in the Manual Checks Bank field under Setup > Other Definitions > Accounts Payable tab; you can select another bank code from the list if you wish.

Payment Amt Specify the amount of the check.

Check Amt Displays a running total of check with multiple invoices paid by a single check number.

Check # Enter the check number. You can enter the same check number multiple times for the same batch to pay multiple invoices. Each occurrence of the check number must have the same vendor code and apply date.

Check Date Enter the check date. This date will be displayed on the check. If "Force check date to be equal to apply date" is checked in Other Definitions, this field will be disabled.

There are four transaction types (Trx Type field) available for manual checks:

Regular Check Used to record the typical form of manual check. You will enter a check date and check number (required fields); the check will be credited against the cash account associated with the Manual Checks Bank defined under Setup > Other Definitions > Invoices & Checks Tab. You can select another bank account if you wish. Compeat will not allow duplicate check numbers for the same bank account.

E.F.T. Used to record electronic fund transfers. E.F.T. transactions do not need a check number (the field will be disabled); the E.F.T. will be credited against the cash account associated with the defined bank account, which you can change if you wish. E.F.T. manual checks will appear in the check reconciliation with "E.F.T." in place of a check number.

Credit Memo Used to enter a credit memo against a specific check number. This feature is not a means to store a credit memo in the system, but rather a way to apply a credit memo to a manual check at the time you cut the check. The credit memo must include the check number to which it is applied, and the resulting balance after deducting the credit memo from the check must be a positive number. Tho enter a credit memo into the system to be used at a later date, use AP Invoices and select Credit Memo as the Doc Type.

Zero Check Zero check transactions do not have a check number or check amount, nor do they affect the cash account. They are typically used to adjust inventory in cases where there was a cash payment to a vendor with the payment recorded through the DSR (see Example below). For further discussion on this, visit the Compeat Support Website.

Example:

Assume a beer vendor is paid $100 in cash from the register, and the cash

withdrawal is entered in the DSR as a paid out. Subsequently, you should

make a zero check type manual check entry to adjust the inventory; the

entry might appear similar to the following:

Note: A zero check makes sense only when using the inventory features of Compeat; that is, if "Enter Line Item Detail" is selected in the Invoice & Check Settings tab under Setup > Other Definitions.

With this feature, you can allocate freight and tax costs across line item detail. Costs are applied across the line items weighted by the extended price. This option can be turned on through the group security screen. Clicking the 'Allocate Costs' button opens this window:

After entering the tax and freight amounts for the invoice, press 'Allocate'. The amounts on the check detail will change to reflect the tax and freight allocation:

The 'Clear Totals' button allows the running total to be reset. It does NOT affect already allocated amounts.

If a user wishes to reverse an allocation, they should enter a new negative allocation amount that will be applied against the current state of the check detail:

Clicking 'Allocate' will apply the negative amounts, reversing the previous allocation.

The Quick Checks feature allows you to print a check for an invoice that doesn't yet exist in the system. When you post a Quick Check invoice, the system automatically posts the invoice, creates a payment batch, and adds the invoice to the payment batch. Once you print a check, the payment batch gets automatically posted.

Once you have completed the needed information to create a Quick Checks invoice, click Print Quick Checks. A payment batch will be automatically created and posted for the account specified in the print dialog.

Note: Quick Checks must have a Trx Type of Reg. Check or Credit Memo.

The Quick Check Print dialog box that appears gives you an immediate opportunity to print a check for that voucher:

Click Print to print the check.