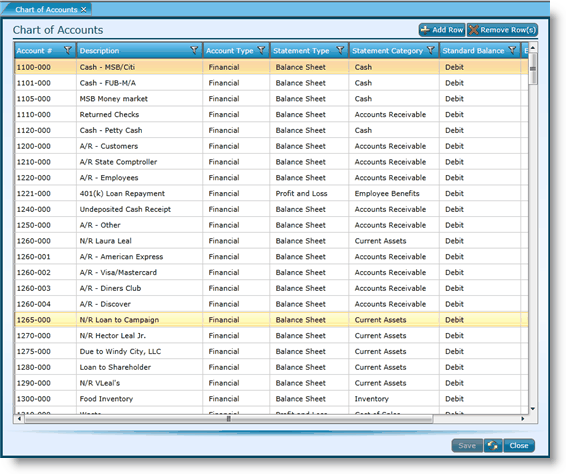

Labor Admin > Labor Definitions > Chart of Accounts

The chart of accounts screen allows you to enter information for each account that will be part of the chart of accounts for your business. These accounts are shared by all entities; there is only one chart of accounts defined for an enterprise.

Compeat Advantage provides a default chart of accounts that you can use as a starting point to build your chart of accounts, if you wish.

Important: Compeat highly discourages setting up separate accounts for different stores. This will have undesirable downstream consequences, as the system is designed to use a single chart of accounts across all stores in an enterprise. If you are setting up your chart for the first time, you may wish to read further information within Compeat Advantage Help.

Note that you cannot initially set up your chart of accounts within Workforce. You will need to do this in Advantage. You can, however, make edits to the current chart of accounts in Workforce.

1.Click the Add Row button.

2.Click in the Account # field and add an account number. The account number can be in any format but cannot exceed 8 characters. Once an account number has been saved it cannot be edited. If an account does not have activity you can delete it and enter the correct number, but once transactions have been posted to this account then you can only make it inactive.

3.Click in the Description field and add a description. This description will be included on financial statements if there is activity in the account.

4.Click in the Account Type field and choose an account type from the drop-down. The account type specified must be one of the following:

oFinancial: Any account type - whether sales, expenses, assets, liability, or owner's equity - that would appear on your financial statements.

oStatistical: Any account that records information normally not appearing on standard balance sheets or income statements. Values in statistical accounts would normally appear on other management or operating reports, and can be used as the basis of further calculations. Guest count and check average are examples.

5.Click in the Statement Type field and choose a statement type from the drop-down. The financial statement type specified controls how the account is treated by the Close Year utility, and which eXcellent™ Financial Functions are used with the account. The statement type can be one of the following:

oBalance Sheet: These include asset, liability, and equity accounts. Balance sheet accounts are always viewed on a financial statement as of a specific date, that is, at a point in time. If a balance should carry forward for an account, specify balance sheet.

oProfit & Loss (P & L): These include income, expense, and cost of goods sold (COGS) accounts. P & L accounts are always viewed on a financial statement as activity occurring between two dates. If an account should have a zero balance at the beginning of a fiscal year, specify profit & loss.

6.Click in the Statement Category field and choose a statement category from the drop-down list. The sub-category of the statement type specified above (either 'Balance Sheet' or 'Profit & Loss') that this account will be reported under. The list of available statement categories changes depending whether 'Balance Sheet' or 'Profit & Loss' is selected above. If statement category is left blank, the account will not appear on Compeat Advantage's predefined balance sheet and profit & loss reports. Compeat Advantage comes with standard categories predefined, but these can be modified or augmented as needed in the statement categories screen.

Important: If the account is used to pay dividends, the statement category must be set to 'Dividends' prior to closing the year. Failure to do so will cause the close year procedure to produce erroneous results.

7.Click in the Standard Balance field and choose from the drop-down. In accounting, the five account types have debit or credit balances. Indicate the standard balance for the account being created; can be one of the following:

oCredit: Typically used for sales, liability, and owner's equity accounts.

oDebit: Typically used for asset and expense accounts.

8.Click in the External Account # field and enter it if it is applicable. If you are using accounting software other than Compeat Advantage, you must enter, if different, the account number that corresponds to the Compeat Advantage account number.

9.If the account should be active, place a check in the Active check box. Uncheck this box to deactivate an account you are no longer using. If an account is not active, it cannot be selected on the AP Invoices, Manual Checks, General Journals, or almost any other screen in Compeat Advantage or Workforce.

10. Put a check in the Apply Currency Ex box if applicable. The consolidate feature in Compeat Advantage will apply the currency exchange rate only to statistical accounts that are checked. Values such as guest counts normally should not be affected by an exchange rate. Statistical accounts that record monetary values should be checked. Non-monetary statistical accounts should not be checked. Only statistical accounts are affected by this field.

11. Click the Save button.

1.Click in any field to edit it.

2.Make edits.

3.Click the Save button.

Unless it is a setup error in the initial creation of an account, you will probably never want to remove or delete any account. Even if you have accounts that you no longer use, you will want to leave them as they may be tied to historical records. Instead, to make it unavailable, deactivate it by unchecking the Active box.

1.Uncheck the appropriate Active check box.

2.Click the Save button.

Send feedback on this topic.